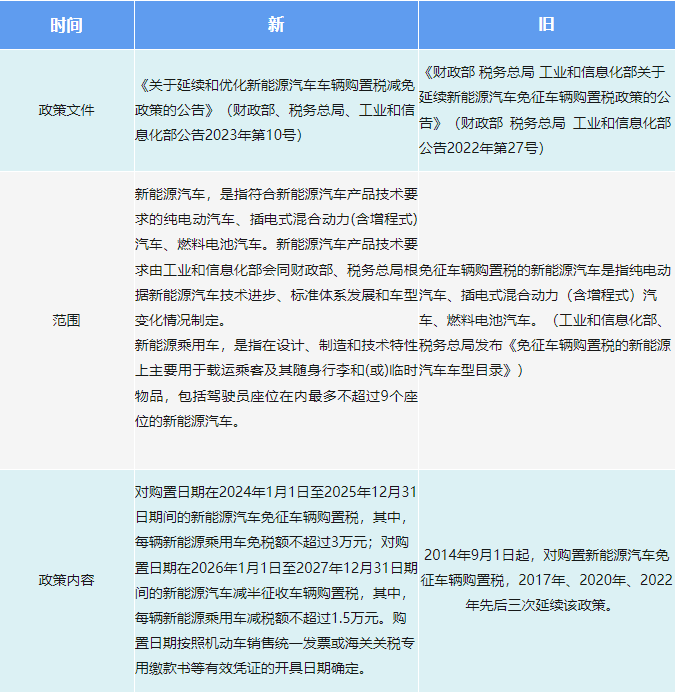

In June this year, the "Announcement of the Ministry of Finance, State Administration of Taxation, and the Ministry of Industry and Information Technology on Continuing and Optimizing the Vehicle Purchase Tax Reduction and Reduction Policy for New Energy Vehicles" (Announcement No. 10 of the Ministry of Finance, State Administration of Taxation, Industry and Information Technology, 2023) was released. Today, Let’s understand the comparison between the old and new policies and the key points of the policies!

01 Comparison of old and new policies

02 Policy Focus

1: Reduction amount limit

For vehicles with a purchase date from January 1, 2024 to December 31, 2025, the tax exemption limit for each new energy passenger vehicle shall not exceed 30,000 yuan.

For vehicles whose purchase date is from January 1, 2026 to December 31, 2027, which enjoys a 50% tax reduction, the tax reduction for each new energy passenger vehicle shall not exceed 15,000 yuan.

2: Segmentation of exemption period

This new policy directly extends the purchase tax for 4 years, and the reduction rate will be reduced gradually within 4 years.

New energy vehicles with purchase dates between January 1, 2024 and December 31, 2025 are exempt from vehicle purchase tax, and the tax exemption for each new energy passenger vehicle shall not exceed 30,000 yuan;

The vehicle purchase tax will be halved for new energy vehicles purchased between January 1, 2026 and December 31, 2027. The tax reduction for each new energy passenger vehicle shall not exceed 15,000 yuan.

3: There are special regulations for new energy vehicles in "battery swap mode"

When the seller sells new energy vehicles in the "battery swap mode", if the sales of new energy vehicles without power batteries and power batteries are calculated separately and invoices are issued separately, the sales volume of the new energy vehicles without power batteries will be calculated based on the motor vehicles obtained by the car buyers when purchasing new energy vehicles without power batteries. The tax-exclusive price stated on the unified sales invoice shall be the vehicle purchase tax taxable price.

03 Case Analysis

Question: Xiao Li plans to buy a new energy passenger car in 2024. He has chosen two models that meet the conditions. One of the cars is priced at 250,000 yuan before tax, and the other is priced at 400,000 yuan before tax. Which vehicle How much is the purchase tax?

Analysis: According to the "Announcement on Continuing and Optimizing the Purchase Tax Reduction and Reduction Policy for New Energy Vehicles" (Announcement No. 10 of 2023 of the Ministry of Finance, the State Administration of Taxation, and the Ministry of Industry and Information Technology), for vehicles with purchase dates between January 1, 2024 and New energy vehicles during the period of December 31, 2025 are exempt from vehicle purchase tax, of which the tax exemption for each new energy passenger vehicle shall not exceed 30,000 yuan.

If you purchase a vehicle worth 250,000 yuan, the calculation is: 25*10%=25,000 yuan (not exceeding 30,000 yuan), so this vehicle is exempt from vehicle purchase tax.

If you purchase a vehicle worth 400,000 yuan, the calculation is: 40*10%=40,000 yuan (more than 30,000 yuan). Therefore, the vehicle purchase tax required for this vehicle is: 4-3=10,000 yuan.

Reprint|Anhui Taxation